The Personal Lines Insurance Market is in a Tough Place

posted by TrueNorth Risk Management on Wednesday, July 19, 2023

The Personal Lines Insurance Market is in a Tough Place.

Insurance carriers are losing money on home and auto insurance policies. On average, for every $1.00 of homeowner’s premium taken in, insurance companies are paying out $1.11 in claims and expenses.

Why are homeowner claims so high?

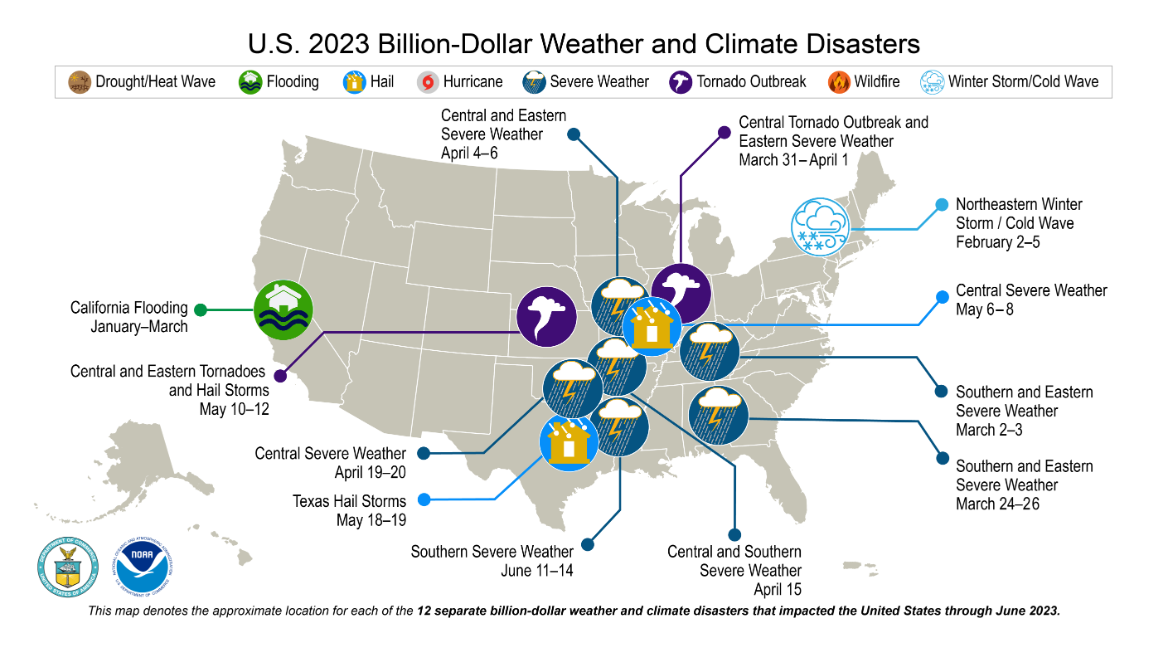

- Increased wind, hail & wildfire events across the nation including:

- 2020 Derecho in the Midwest & Wildfires in the West Coast

- 2021 Winter Storm in Texas, Wildfires Colorado, West Coast & Arizona

- 2022 Midwest Winter Storm and Cold Streak, Wildfires in the West Coast

- 1st half of 2023 Increased Wind & Hail storms in Midwest

- Inflation - costs to repair or rebuild a home have sky-rocketed

- 53% increase in steel

- 35% increase in lumber

- 16% increase in skilled labor wage

To counter the increasing loss costs, many insurers continue to raise their rates.

Because of this, consumers are experiencing significant premium increases on their home and auto policies.

What can you do about it?

Visit with your TrueNorth Representative to discuss coverage options to help mitigate premium increases and reduce the number and severity of potential claims.

Discounts may be offered through insurance carriers for strategies including:

- Higher deductibles

- Alarm systems or “Smart Home” monitoring systems –This will also help with preventing potential claims giving you more control on the risks/deductibles that you are willing to take on.

- Have you upgraded your Home? Some Insurance companies offer discounts for:

- New roofs

- New heating and air conditioning systems

- Electrical improvements

Auto Insurance is facing the same issues.

Inflation, rising medical costs, and escalating prices of parts & equipment are just a few of the factors contributing to the rise in auto claim costs.

Options to create discounts Include:

- Drive carefully – It may seem simple, but those with no or very few claims enjoy lower premiums

- Increase deductibles

- Smart Ride – Earn potential discounts based on your driving behaviors.

- Go Paperless – elect electronic delivery of policies and billing.

- Enroll in automatic monthly billing via ACH or credit card

Today’s insurance market is requiring consumers to think outside the box. Implementing risk mitigation factors into your personal life can help combat rising insurance costs.

The days of finding the cheapest insurance and switching insurance carriers every year is gone. Insurance Carriers are declining or surcharging consumers who are jumping from one provider to another.

Our team is trained to walk you through best practices and help find the best options that are right for you. Talk to your TrueNorth representative, or fill out the form below to have someone reach out to you today.

*Insurance Journal May 2023

AGC July 2022

About Author

In addition to helpful weekly guidance on home and auto, TrueNorth provides a number of insurance options to protect your family from risk. For information on a home or auto quote, visit www.iTrueNorth.com or call us at (319) 739-1277. We'd like nothing more than to help safeguard the things that matter most to you.

Obtain a quote on home or auto

Learn more about TrueNorth Risk Management

... read more about author